Financial advice for a new generation of stewards

You've built something—or inherited something. Now you want to do it right. We combine credentialed expertise with modern, human-centered thinking to help you manage wealth with clarity and intention.

Serving families with $1M+ portfolios in the Berkshires and beyond.

⚖️

MODERN WEALTH MANAGEMENT

A human-centered approach that balances sophisticated financial strategies with mindful living principles.

📜

CREDENTIALED EXPERTISE

CFP® and CIMA® professionals with 40+ years of combined experience serving multi-generational families.

🌿

HOLISTIC PHILOSOPHY

Where financial planning meets intentional living—integrating wealth management with personal values and purpose.

-

Creative minds.

Clear thinking. Calm guidance.

We’re financial advisors, yes—but also creative thinkers who understand that life doesn’t follow a spreadsheet.

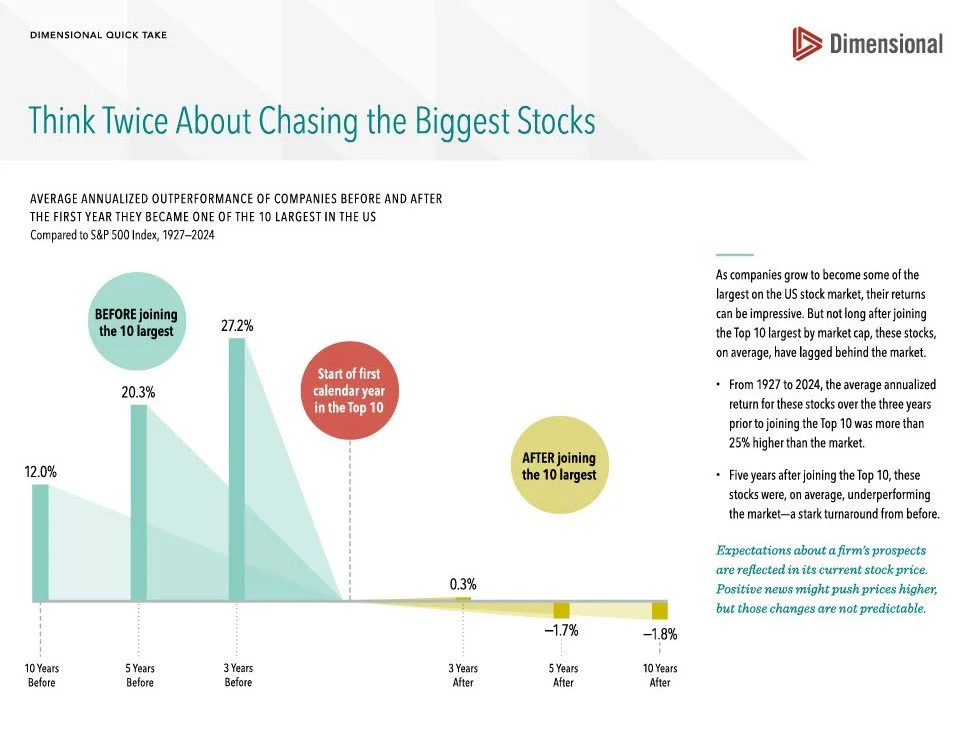

With decades of experience and deep credentials (CFP® and CIMA®), we bring a rigorous, evidence-based approach to financial planning and investment management. Our strategies are rooted in academic research, not market timing or guesswork.

But what sets us apart isn’t just our credentials. It’s our curiosity. Our empathy. And our ability to work with clients whose lives don’t fit neatly into a traditional financial mold.

We’ve advised purpose driven professionals, musicians, artists, entrepreneurs, new inheritors, people in transition and —people navigating success on their own terms.

We're based in the Berkshires, but we work with people from all over the country and beyond who are thoughtful, creative, and ready to bring clarity to their financial lives.

We believe that financial advice should feel like a deep breath, not a sales pitch.

-

People with purpose. Assets with complexity. Lives in motion.

Most of our clients have between $2 and $10 million in investable assets. But that’s not what defines them.

They are:

Individuals, couples and families who want to align their money with their values.

New inheritors trying to make sense of unexpected wealth.

People in transition selling a business, retiring early, starting over.Musicians, artists, and writers with irregular income but steady vision.

Entrepreneurs in the middle of building something—or gracefully exiting.They may not see themselves as “wealthy,” but they know their financial lives have grown too complex to manage alone.

They want straight answers, smart strategies, and a relationship built on trust—not jargon or posturing.

-

Planning, perspective, and evidence-based investing.

Financial Planning

We help you clarify what you want your money to do—now and in the future. From retirement planning to tax strategies and legacy goals, we provide a roadmap to help turn your intentions into reality.Investment Management

The portfolios we construct for our clients are grounded in decades of data—not speculation. With global diversification and long-term discipline, we take the stress out of investing through education and a steady, evidence-based approach.Ongoing Partnership

We’re not just planners—we’re partners. When life changes, we’re here. Acting as the coach on your team, we work closely with your attorney, accountant, and other advisors to keep everything aligned.

Our goal isn’t just to grow your wealth—it’s to protect it, simplify the process, and help you feel more confident in the legacy you’re building.

Certified Financial Planner Board of Standards Center owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Our Services

Comprehensive wealth management tailored to your unique goals

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation.